Environmental Social Governance Fund

UK & Kenya

Horizon Consortium

The consortium collectively commits to mobilize the necessary financial and technical resources as spelt out in the partner’s terms of responsibilities, directly or through a third party.

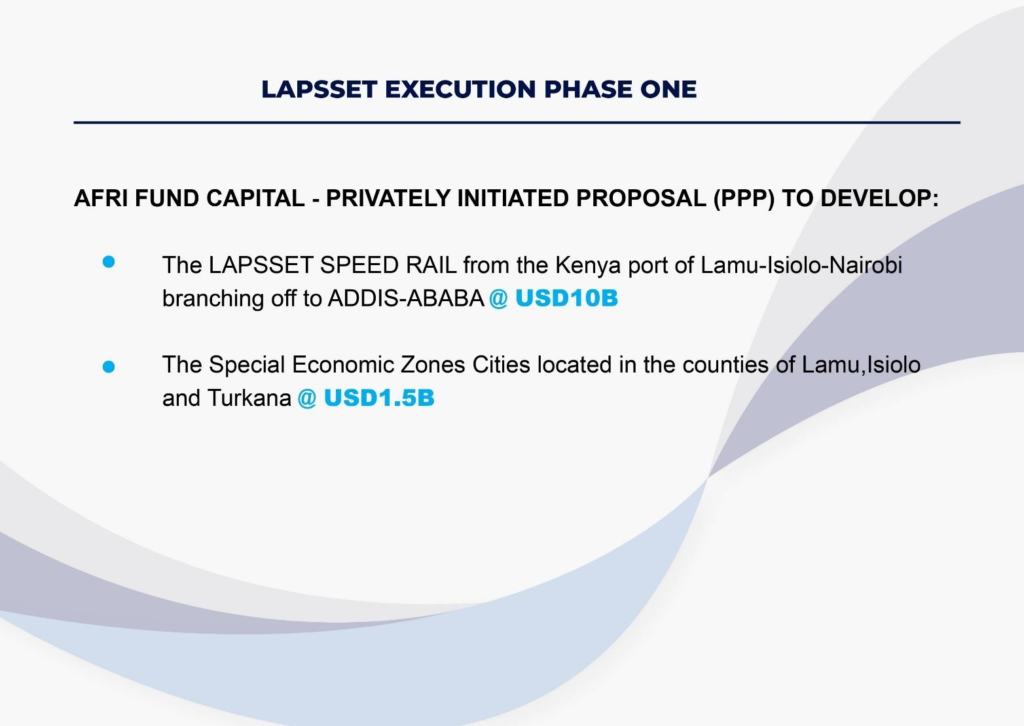

Massive Investment

Infrastructure & Power sector investment to help correct the poverty level in Kenya and forge ahead with the Lapsset Corridor.

Full funding arranged through Afri-Fund-Capital – PSECC Ltd

Credinvest International Finance – UK Export Finance – EIB, Climate Finance,

Turkey Eximbank & US Eximbank

Funding is Equity led – 30% investment from Government, 35% from Afri Fund Capital & 35% from other PSECC Ltd Private Equity investors.

NEWS

10 NOVEMBER 2022

Kenya targets 30GW of green hydrogen after signing strategic deal with UK

Kenya’s President said it aims to produce 30GW of green hydrogen production after signing a KES500bn deal with the UK to fast track green investments.

The UK-Kenya Strategic Partnership is an ambitious five-year agreement that aims to unlock benefits for both countries.

The UK Government will commit KES2bn to a new guarantee company that will lower investment risk and unlock KES12bn of climate finance for Kenyan projects over the next 3 years, through collaboration with CPF Financial Services and other private investors.

Current status in Kenya

Carbon Offset credits

Based on selling carbon credits the PSECC Energy projects will bring in USD 510 million per year based on USD 6 per ton for Carbon Offsetting credits or US $3.4 Billion each year, based on Bloomberg prices of $40 per ton.

COP28 – US $4.48 Billion secured by President Ruto for Green Developments in Kenya. The Kenya National Adaptation Plan 2015-2030 regrading Energy indicated there are Gaps to progressing Climate Change adaption – Financing, technology, capacity building and research. PSECC Ltd have been researching options over the past year for the Lapsset Corridor Energy & Water projects. As a result Climate Change mitigation is seen as an opportunity and not a burden on Government funding. All of the Renewable Energy projects provide a 30% shareholding for the Government.

PSECC Ltd – “Revenue generation for Kenya – Renewable Energy projects will pay for themselves and provide funding for further Climate Change Mitigation.” PSECC Ltd is also offering assistance to Africatalyst.

Energy Transition and Adaption does not have to cause financial burden on a Country.

Benchmark UK Government funds rate would be between 5.25% and 5.5%. KES sh 150.99=$1

Kenya’s President said it aims to produce 30GW of green hydrogen production after signing a KES500bn deal with the UK to fast track green investments.

The UK-Kenya Strategic Partnership is an ambitious five-year agreement that aims to unlock benefits for both countries.

The UK Government will commit KES2bn to a new guarantee company that will lower investment risk and unlock KES12bn of climate finance for Kenyan projects over the next 3 years, through collaboration with CPF Financial Services and other private investors.

The Malindi Solar Expansion will receive an additional KES7.5bn investment. Plans at the 40MW solar plant, constructed by UK company Globeleq with finance from British International Investment, which was connected to the grid in December 2021, will double the size of Malindi Solar and add battery storage.

Other investments include KES425bn in Grand High Falls Dam – which will generate 1,000MW of hydro-electric capacity – KES12.5bn in Menengai Geothermal and KES31bn in United Green crop and agro-industrial processing system.

President HE William Ruto, addressing delegates at COP27, said Kenya’s electricity green is 93% green and outlined the potential of green hydrogen, before making the 30GW target.

“There exists in Kenya the opportunity to produce 20GW of wind power, 10GW of geothermal electricity, and being at the equator, considerable amounts of solar power. In East Africa there is sufficient hydro-electric potential to produce 100,000MW and if properly exploited, could generate enough clean energy for the whole of the continent.”

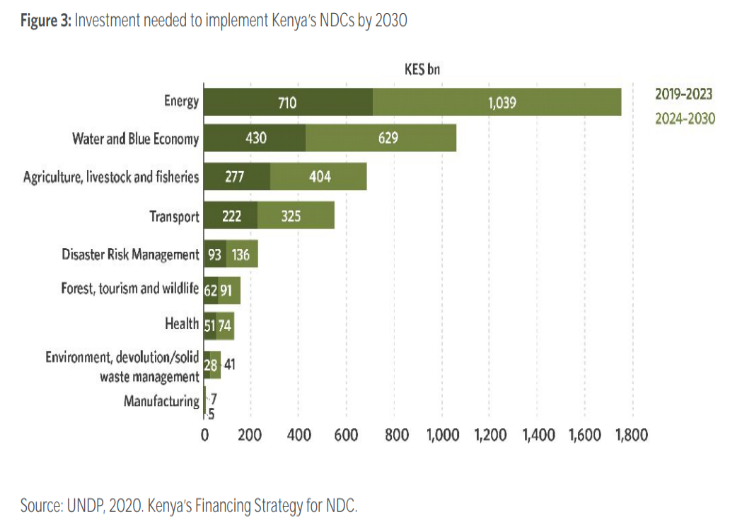

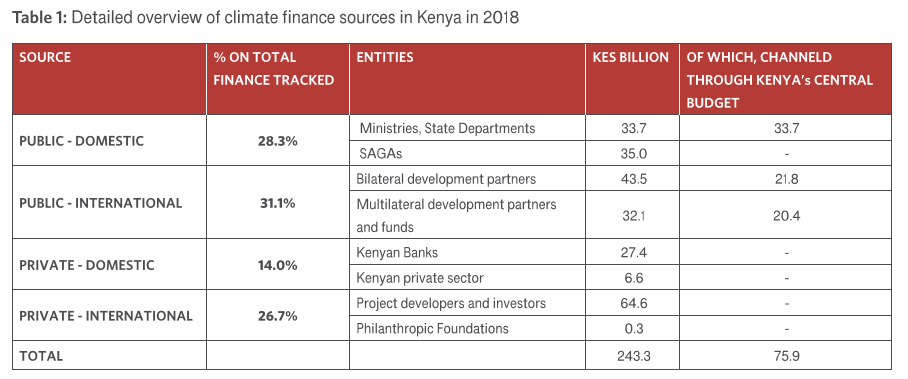

FINANCING KENYA’S National Determined Contribution (NDC)

Financing the implementation of Kenya’s climate ambitions requires significant public and private finance. Kenya’s Financing Strategy for the NDC (UNDP, 2020) estimated USD

40 billion of new investment is needed for the next 10 years (2020 – 2030) to implement priority climate mitigation and adaptation actions. These funds are to be sourced locally and internationally with a significant contribution expected from the private sector.

If this financing requirement is met, the country would abate its GHG emissions by 30% by 2030 relative to BAU scenario and meet the climate adaptation goals stated in its NDC.

The total requirement for the first five years (2019/20 – 2023/24) is USD 18.6 billion, of which USD 8.7 billion for adaptation and USD 9.9 billion for mitigation actions; and an additional USD 21.4 billion is needed for 2024 – 2030

Funding required for NDC

Source: The Landscape of Climate Finance in Kenya – On the road to implementing Kenya’s NDC – March 2021

Green

Climate Fund

Other funding could also be applied, if required from:

A massive global infrastructure investment of $66 trillion is needed in emerging economies before 2030. The Belt and Road Initiative (BRI) offers a new development paradigm by investing in green infrastructure, which is necessary to avoid the irreversible carbon lock-in effect on global climate change.

This insight report highlights the low-carbon technologies, green finance developments and enabling environments as well as the broader stakeholder ecosystem needed for green development of the BRI. These are illustrated by engaging case studies based on interviews with Green Investment Principles signatories, multilateral development banks and selected organizations that are harnessing cutting-edge business models to achieve decarbonization and the SDGs. The report is a call for knowledge development and further multistakeholder collaboration to build a sustainable future.

Other interesting COP28 initiatives that may be linked into for Lapsset Corridor if appropriate.

Meeting on the 19th February 2024

Below is the video of the session on Climate Change Finance & major Banks

Innovative Solutions for a Developing World

Over Four Decades of Experience & Success

Global Project Management • Infrastructure Development • Finance

COP28 – Europe, China and the USA agree on Climate Change Mitigation November 2023.

With an accelerated global population growth exacerbated by consumption habits, there is an immediate need for countries to adopt waste management technologies to mitigate the consequences of climate change. We lead the design and implementation of Waste-To-Energy technologies diverting waste into clean energy with active projects in Asia and Africa. The implementation process we handle includes planning, engineering, procurement, contract management, and funding.

KETRACO PARTNERS

For Lapsset Corridor Renewable Energy projects the Government & LCDA do not pay back this funding, pay back is through the PPA’s – Power Purchase Agreements

Total project finance comes in at an interest of approximately 5.5% (still to be negotiated).

Green Bond Investment

Example – Tanzania

The Tanga Urban Water Supply and Sanitation Authority (Tanga Uwasa) in Tanzania has just issued a $20.8 million green bond. The proceeds of this bond will enable the public body to increase its production of drinking water.

Tanzania is entering the green bond market. The first bond was recently issued by the Tanga Urban Water Supply and Sanitation Authority (Tanga Uwasa), which hopes to raise 53.12 billion Tanzanian shillings (more than $20.8 million) through this financial operation.

“The aim is to raise funds to enable the company to increase its production of drinking water with a view to achieving universal coverage in the city of Tanga, compared with 96% at present, and to support its environmental conservation efforts in the city and neighbouring towns”, says Tanga Uwasa, which also supplies the towns of Muheza and Pangani in Tanzania. The company also collects and disposes of wastewater in the three cities.

This transaction will be supported by Financial Sector Deepening (FSD) Africa, a Kenyan development agency, financed by UK International Development, which provided technical assistance.

Towards the diversification of water financing in Tanzania?

At the same time, the $20.8m green bond will be listed on the Dar es Salaam Stock Exchange (DSE), offering a yield of 13.5%, paid semi-annually.

The success of this experiment could encourage other players in the Tanzanian water sector to issue green bonds to finance green initiatives in this East African country, which is aiming for universal access to drinking water by 2030. Currently, water coverage is 86% in urban areas and 72.3% in rural areas.

Nations & all Governments join the Net Zero programme

A unique global platform to respond to climate change by investing in low-emission and climate-resilient development. $100 Billion

GCF established by 194 governments to limit or reduce greenhouse gas (GHG) emissions in developing countries, and to help vulnerable societies adapt to the unavoidable impacts of climate change

Glasgow

Financial Alliance

for Net Zero

Bringing together the financial sector to accelerate the transition to a net-zero economy. $130 Trillion pledged.